This is a quick update on my

recent post on corporate accounting and EPS.

The FT ran a rather bullish

story the other day proclaiming that corporate America is spending again, a sign

of returning confidence they told us.

Their ebullience seems to

have been triggered by the fact that, according to a survey by the Association

for Financial Professionals, corporations’ cash balances have been falling. The

FT assures us that this is an important turning point in our recovery from the

Great Recession. Accordingly, this is a

clear sign that animal spirits are returning to the US economy.

If only it were true. The FT

starts the story this way:

US corporations are starting to run down their cash

for the first time since the recession- a sign of returning confidence- but

they remain reluctant to invest in new equipment.

Let me give you my

translation of this line:

US corporations are confident in their ability to

boost earnings per share so long as they DON’T invest in their businesses by

purchasing new equipment.

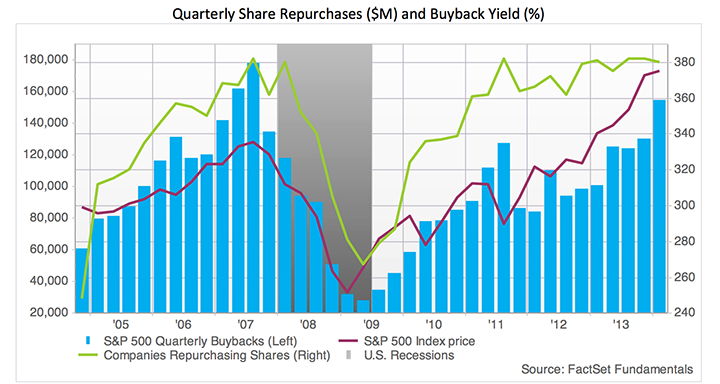

The story does note that buybacks

and acquisitions are what the cash is being used for, but it neglects one small

detail that may be important: Cash is going down despite the fact that

businesses, in the US anyway, are borrowing money at a faster rate.

According to the Fed’s Z.1

report:

Annual Business Borrowing

($ billions)

Year Amount

2011 295

2012 532

2013 516

2014* 700

* Annualized YTD numbers

Here is what we know, annualized

borrowings have jumped nearly 40% this year, companies refuse to reinvest to

grow their businesses and corporate profits have flattened out:

After Tax Corporate Profits

with Inventory Valuation and Capital Consumption Adjustments

(SAAR, $ Billions)

Period Amount

Q2 2012 1551

Q3 2012 1600

Q4 2012 1594

Q1 2013 1565

Q2 2013 1644

Q3 2013 1673

Q4 2013 1648

Q1 2014 1380

Q2 2014 1498

Source: Economagic, BEA

BEA defined profits differ

from what we see in GAAP accounting. The BEA only wants to show the economic impacts

from production in a current period. As such, it eliminates inventory profits

and losses, adjusts depreciation expense to reflect current, real, depreciation

and it strips out capital gains and losses and things like changes in expenses

for bad debt.

As we can see from the above

table, real economic profit growth is becoming tough to come by as profits have

now fallen for three straight quarters.

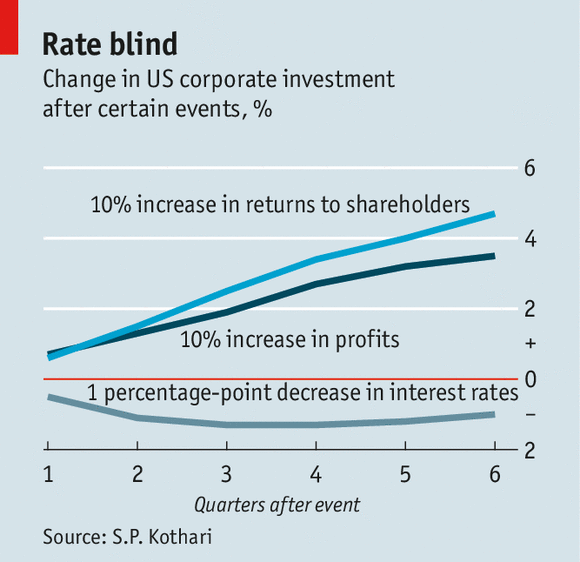

So, where does this leave the

corporate executive? He can no longer seem to grow his business top line. Over

the past year, half of the companies listed in the Dow have seen negative real

sales growth. Additionally, the Fed’s abusive interest rate policy has crushed

any incentive to reinvest since incremental returns on capital must equal

incremental costs. These are now set at zero, thanks to the Fed. Growth at the bottom line seems

to have peaked, as well.

This leaves the corporate

executive who wants to show EPS growth with share buybacks and acquisitions. Corporate

capital allocators have been pushed into the equity markets, just like all

other investors, as it appears to be the only place where a return in excess of

punitively low interest rates can be generated. As stock prices rise, however,

it is costing companies more to reduce their share count by a similar amount.

This is what explains the need for more borrowing and lower cash balances. In fact, companies are buying shares at dramatically higher prices today than two

years ago despite the fact that economic profits have fallen over this time.

As Austrian Business Cycle

Theory teaches, central bank interest rate policies can act in a way that fools

most capital allocators by sending signals that push these capital allocators to do the

wrong thing at the wrong time. This is true of corporate executives today, in

my opinion.

The FT wants to proclaim that

the decline in corporate cash balances is a sign of strength for businesses. I

see it very differently. My view is that the corporate world is trapped, and

their only option at the moment is to buy overvalued shares in businesses that

cannot grow any longer. This will end badly.

I will point out that BEA

after tax profits peaked well in advance of the peaking of share prices in 2000

and 2007. Those were also periods of time, not coincidentally, that

saw a less accommodative Fed. Will

declining economic profits and a less profligate Fed combine, once again, to

crush investors?

Disclaimer: Nothing on this site should be construed as investment advice. It is all merely the opinion of the author.