Wednesday, February 28, 2018

Most Bullish Bitcoin and Gold Item in Decades

In what is the biggest news I have seen in my 18 years of looking for an alternative to fiat, Germany has decided they won't place a capital gains tax on purchases made with crypto. This eliminates the double taxation of alternate currencies that is created from the debasement of fiat that I wrote about last week. This should benefit crypto gold as well. This should force other countries to move on this matter as well.

I Want to Like Gold, but.....

The world is short an honest money. Gold and bitcoin both offer better options than the current failing system, it is just that crypto keeps chipping away at some of what were gold's best attributes in ways that keep surprising me.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Wednesday, February 21, 2018

The Problem with Centralization

Twitter has shut down thousands of accounts. The reason is unimportant, but the fact is that when a system is centralized those with views that are in opposition with those views of the central authority are at risk of being cutoff. This is very true in a system where money is centralized. Bitcoin's success is extremely important to those who do not want to see themselves arbitrarily removed from the financial system by some central authority. Just as Twitter and Facebook may remove your ability to speak on their platform for any reason, governments and central banks can do this on their centralized financial platform. Bitcoin is the answer.

Disclaimer: This is not financial advice.

Disclaimer: This is not financial advice.

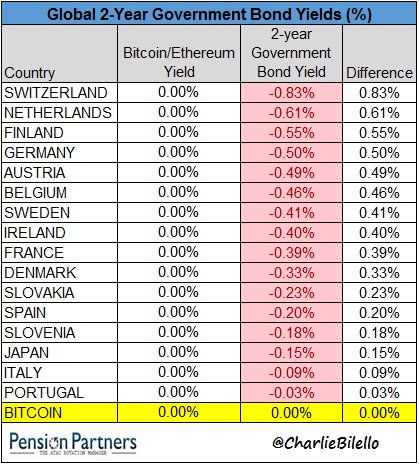

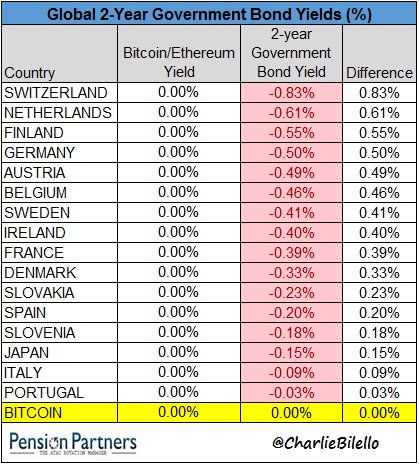

A Big Reason to Trust Bitcoin Over Central Bankers

https://twitter.com/charliebilello/status/966325031189057537

Disclaimer: This is not investment advice.

Disclaimer: This is not investment advice.

Taxes and bitcoin

Central bankers and those cronies who sit close to them are mighty quick to dismiss bitcoin. Nevertheless, bitcoin's price rises. Impressively, it does so while fighting with one arm tied behind its back.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Trust and bitcoin

Bitcoin is a horrible name. Trustnet would be better.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Monday, February 19, 2018

Game Theory and Rebalancing the System

Over the years I have had discussions about gold and the price required to rebalance the system. I think that I, and many others, have used this argument to quiet those who say there isn't enough gold out there to return to a system where gold is money. "Ridiculous," was the response. Just slap another zero onto the price (now maybe we need a 20 bagger) and voila, problem solved.

It is interesting to see this argument creeping into the bitcoin world. Foolish or not, Bill Tai at a recent Milken Institute conference proffered the theory that the Japanese government's rapid move to push bitcoin into use there is being done along these lines. He finds it amazing that a culture built on consensus where change happens slowly has pushed so rapidly and so hard on the bitcoin front. He considers the possibility a good one that the government knows there is almost no way out of their financial mess, and they hope that by being a first mover on crypto that its rapid appreciation will bail them out. Interesting.

You can see his comments here at about the 55:00 mark:

Cointelegraph also ran a story on the Polish central bank paying to run anti-crypto ads that was picked up at Zero Hedge. As I wrote last week, central bankers bashing bitcoin reminds me of the Max Planck argument about science progressing one funeral at a time. Planck understood that those in the scientific world who had operated their entire adult lives under certain assumptions about how the world worked were loath to accept new theories that rendered their life's work moot. Planck knew that it was almost impossible to convince these older folks that the new theory was correct. Only after they had all died was it possible for the new theory to be broadly accepted.

Many central bankers, I think, are like this with regard to bitcoin. It isn't that they don't understand bitcoin, they do. What the really fear is that bitcoin renders them and their life's work of fiat promotion moot.

Where the Planck Theory that I proposed above goes awry is that there may be a big game theory aspect to the acceptance and rejection of bitcoin and crypto. It will be interesting to watch. Poland and China are at one end of the spectrum with Japan and Switzerland at the other. There may come a time where wide scale bitcoin acceptance pushes even the most reluctant into bitcoin acceptance. It may even have already happened.

Disclaimer: This doesn't constitute investment advice.

Subscribe to:

Posts (Atom)