Wednesday, February 28, 2018

Most Bullish Bitcoin and Gold Item in Decades

In what is the biggest news I have seen in my 18 years of looking for an alternative to fiat, Germany has decided they won't place a capital gains tax on purchases made with crypto. This eliminates the double taxation of alternate currencies that is created from the debasement of fiat that I wrote about last week. This should benefit crypto gold as well. This should force other countries to move on this matter as well.

I Want to Like Gold, but.....

The world is short an honest money. Gold and bitcoin both offer better options than the current failing system, it is just that crypto keeps chipping away at some of what were gold's best attributes in ways that keep surprising me.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Wednesday, February 21, 2018

The Problem with Centralization

Twitter has shut down thousands of accounts. The reason is unimportant, but the fact is that when a system is centralized those with views that are in opposition with those views of the central authority are at risk of being cutoff. This is very true in a system where money is centralized. Bitcoin's success is extremely important to those who do not want to see themselves arbitrarily removed from the financial system by some central authority. Just as Twitter and Facebook may remove your ability to speak on their platform for any reason, governments and central banks can do this on their centralized financial platform. Bitcoin is the answer.

Disclaimer: This is not financial advice.

Disclaimer: This is not financial advice.

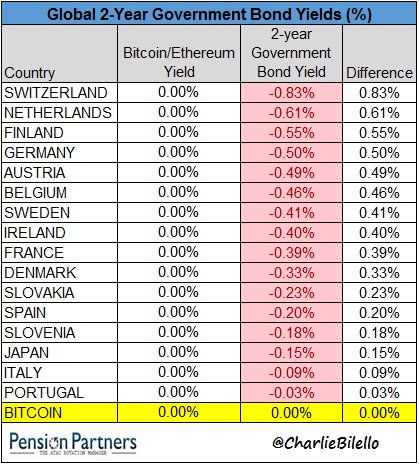

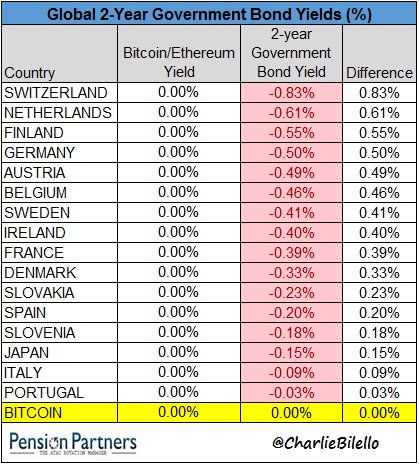

A Big Reason to Trust Bitcoin Over Central Bankers

https://twitter.com/charliebilello/status/966325031189057537

Disclaimer: This is not investment advice.

Disclaimer: This is not investment advice.

Taxes and bitcoin

Central bankers and those cronies who sit close to them are mighty quick to dismiss bitcoin. Nevertheless, bitcoin's price rises. Impressively, it does so while fighting with one arm tied behind its back.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Trust and bitcoin

Bitcoin is a horrible name. Trustnet would be better.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Monday, February 19, 2018

Game Theory and Rebalancing the System

Over the years I have had discussions about gold and the price required to rebalance the system. I think that I, and many others, have used this argument to quiet those who say there isn't enough gold out there to return to a system where gold is money. "Ridiculous," was the response. Just slap another zero onto the price (now maybe we need a 20 bagger) and voila, problem solved.

It is interesting to see this argument creeping into the bitcoin world. Foolish or not, Bill Tai at a recent Milken Institute conference proffered the theory that the Japanese government's rapid move to push bitcoin into use there is being done along these lines. He finds it amazing that a culture built on consensus where change happens slowly has pushed so rapidly and so hard on the bitcoin front. He considers the possibility a good one that the government knows there is almost no way out of their financial mess, and they hope that by being a first mover on crypto that its rapid appreciation will bail them out. Interesting.

You can see his comments here at about the 55:00 mark:

Cointelegraph also ran a story on the Polish central bank paying to run anti-crypto ads that was picked up at Zero Hedge. As I wrote last week, central bankers bashing bitcoin reminds me of the Max Planck argument about science progressing one funeral at a time. Planck understood that those in the scientific world who had operated their entire adult lives under certain assumptions about how the world worked were loath to accept new theories that rendered their life's work moot. Planck knew that it was almost impossible to convince these older folks that the new theory was correct. Only after they had all died was it possible for the new theory to be broadly accepted.

Many central bankers, I think, are like this with regard to bitcoin. It isn't that they don't understand bitcoin, they do. What the really fear is that bitcoin renders them and their life's work of fiat promotion moot.

Where the Planck Theory that I proposed above goes awry is that there may be a big game theory aspect to the acceptance and rejection of bitcoin and crypto. It will be interesting to watch. Poland and China are at one end of the spectrum with Japan and Switzerland at the other. There may come a time where wide scale bitcoin acceptance pushes even the most reluctant into bitcoin acceptance. It may even have already happened.

Disclaimer: This doesn't constitute investment advice.

Saturday, February 17, 2018

What Happened to Bitcoin in 2017

By all accounts, bitcoin's rise in 2017 was meteoric. What does this mean? Why did it happen?

One of the principle tenets of this blog is that fiat money has been abused through endless rounds of central bank debasement and this has created many problems. Those of us who hold fast to the ideas of Austrian Business Cycle Theory have very different ideas than do most economists as to what impact this debasement has on the economy. Austrians believe that printing money distorts interest rates and time preferences and these things will impact the very structure of the economy in a way that the market doesn't appreciate. That is, people do stupid things when the information (interest rates) they are given is distorted. The economic result is malinvestment.

In this sense, money is a subset of speech. Money, and the way we use it, tells the world what we like, what interests us and what our time preferences are. Money and its use contains extremely important information. To get at truth, speech needs to be free, and this is also true for money. It should never be distorted so that the information is skewed in a way that only benefits those in power or those who sit closest to the central banks. There will be no truth or justice there. Central banks have skewed the fiat money system in a way that truth, justice and free speech are denied to most. Bitcoin's dramatic rise in 2017 is a recognition of this.

Since the Great Financial Crisis of 2008, I think that people have had an underlying sense that the financial system has been skewed against them and in favor of the one percent. The individual has seen his free speech silenced by Ben Bernanke, Janet Yellen, Draghi and Kuroda with their distortion of money and interest rates. People are yearning to speak freely, to speak truthfully and to have their voices heard. That is what happened to bitcoin in 2017. People have found their voice again through the purchase of bitcoin and this time I pray that they won't let it be silenced.

Disclaimer: This does not constitute investment advice.

One of the principle tenets of this blog is that fiat money has been abused through endless rounds of central bank debasement and this has created many problems. Those of us who hold fast to the ideas of Austrian Business Cycle Theory have very different ideas than do most economists as to what impact this debasement has on the economy. Austrians believe that printing money distorts interest rates and time preferences and these things will impact the very structure of the economy in a way that the market doesn't appreciate. That is, people do stupid things when the information (interest rates) they are given is distorted. The economic result is malinvestment.

In this sense, money is a subset of speech. Money, and the way we use it, tells the world what we like, what interests us and what our time preferences are. Money and its use contains extremely important information. To get at truth, speech needs to be free, and this is also true for money. It should never be distorted so that the information is skewed in a way that only benefits those in power or those who sit closest to the central banks. There will be no truth or justice there. Central banks have skewed the fiat money system in a way that truth, justice and free speech are denied to most. Bitcoin's dramatic rise in 2017 is a recognition of this.

Since the Great Financial Crisis of 2008, I think that people have had an underlying sense that the financial system has been skewed against them and in favor of the one percent. The individual has seen his free speech silenced by Ben Bernanke, Janet Yellen, Draghi and Kuroda with their distortion of money and interest rates. People are yearning to speak freely, to speak truthfully and to have their voices heard. That is what happened to bitcoin in 2017. People have found their voice again through the purchase of bitcoin and this time I pray that they won't let it be silenced.

Disclaimer: This does not constitute investment advice.

Thursday, February 15, 2018

A Couple of Random Observations

Charlie Munger of Berkshire Hathaway called bitcoin "noxious poison" the other day. Well, to a guy whose business depends on an endless supply of easy money from central banks that transfers wealth from savers to leveraged hedge funds like Berkshire Hathaway, I am certain bitcoin is noxious poison. Good thing, too.

Munger then went on to say that regulators should let up on Wells Fargo, a firm that deliberately set out to open fake accounts and enroll customers in programs that they didn't want and weren't told that they would be charged for. That is, they flat out stole from their customers.

Munger couldn't be more socially tone deaf if he had slapped a couple of female underlings on their backsides and told them they should like it. I think someone needs to keep the 93 year old Munger from embarrassing himself any further.

Finally, noted VC Bill Gurley said that everyone is nauseous from talking so often about crypto and that he wished it would stop. Sorry Bill, the market potential is too big and bitcoin's implications for our freedom and liberty are too important. Did Thomas Jefferson talk too much about man's natural rights in the Declaration of Independence? Should Galileo have stopped talking about the sun being at the center of the universe?

Important ideas will not suffer from too much discussion. Take some Pepto and tough it out.

Disclaimer: This does not represent investment advice.

Munger then went on to say that regulators should let up on Wells Fargo, a firm that deliberately set out to open fake accounts and enroll customers in programs that they didn't want and weren't told that they would be charged for. That is, they flat out stole from their customers.

Munger couldn't be more socially tone deaf if he had slapped a couple of female underlings on their backsides and told them they should like it. I think someone needs to keep the 93 year old Munger from embarrassing himself any further.

Finally, noted VC Bill Gurley said that everyone is nauseous from talking so often about crypto and that he wished it would stop. Sorry Bill, the market potential is too big and bitcoin's implications for our freedom and liberty are too important. Did Thomas Jefferson talk too much about man's natural rights in the Declaration of Independence? Should Galileo have stopped talking about the sun being at the center of the universe?

Important ideas will not suffer from too much discussion. Take some Pepto and tough it out.

Disclaimer: This does not represent investment advice.

Suppression

A decade ago my daughter started competitive swimming. I was impressed by how much work went into the sport. She trained 18 hours per week and went to school. Her dedication also had me paying attention to other developments in the sport.

At about that time USA Swimming, the national organizing body, was undergoing harsh criticism for its having swept many sexual abuse allegations under the rug over the years. The pressure grew and USA Swimming was forced to change its ways and its attitude toward sexual abuse of swimmers by their coaches. A tsunami of charges were unleashed as young women felt that they would now get a fair hearing. The result, there are now 149 people, mostly men, banned by USA Swimming. It has been quite shocking that this level of abuse existed in a sport for children.

Then came Harvey Weinstein. The sad thing here is that it seemed like almost everyone knew what was going on, yet they allowed it to happen anyway. People were willing to look the other way for a chance to get their film made, to get the part or to become a screenwriter (sounds just like the financial markets to me).

Finally, Oprah (who needs no last name) gave an incredibly powerful speech at the recent Golden Globes about the abuse and suppression of women. The reception to her words resulted in there being much talk about her running for president in 2020.

The suppression and abuse of women has exploded into what may be the dominant social issue of the day. I am pretty certain this is not going to blow over.

This brings me to the many other avenues of suppression over a long period of time where anger will build over the scale of the abuse. From the perspective of a blog on economics, the massive suppression of interest rates, volatility and gold prices have harmed millions and will be exposed. This type of suppression is always impossible to hide forever in the economic world. There will be a reckoning. Judgment is coming for the world's irresponsible central bankers.

Disclaimer: This doesn't represent investment advice.

At about that time USA Swimming, the national organizing body, was undergoing harsh criticism for its having swept many sexual abuse allegations under the rug over the years. The pressure grew and USA Swimming was forced to change its ways and its attitude toward sexual abuse of swimmers by their coaches. A tsunami of charges were unleashed as young women felt that they would now get a fair hearing. The result, there are now 149 people, mostly men, banned by USA Swimming. It has been quite shocking that this level of abuse existed in a sport for children.

Then came Harvey Weinstein. The sad thing here is that it seemed like almost everyone knew what was going on, yet they allowed it to happen anyway. People were willing to look the other way for a chance to get their film made, to get the part or to become a screenwriter (sounds just like the financial markets to me).

Finally, Oprah (who needs no last name) gave an incredibly powerful speech at the recent Golden Globes about the abuse and suppression of women. The reception to her words resulted in there being much talk about her running for president in 2020.

The suppression and abuse of women has exploded into what may be the dominant social issue of the day. I am pretty certain this is not going to blow over.

This brings me to the many other avenues of suppression over a long period of time where anger will build over the scale of the abuse. From the perspective of a blog on economics, the massive suppression of interest rates, volatility and gold prices have harmed millions and will be exposed. This type of suppression is always impossible to hide forever in the economic world. There will be a reckoning. Judgment is coming for the world's irresponsible central bankers.

Disclaimer: This doesn't represent investment advice.

Friday, February 9, 2018

Max Planck and Bitcoin

Max Planck understood that many scientists who had spent their entire lives operating under a certain set of assumptions about how the world worked would recoil in horror at new theories that rendered their life's work moot. The old guard was always reluctant to accept a new theory, no matter what the evidence:

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Max Planck

As we see central bankers throw out disparaging remarks concerning bitcoin, I would encourage you to think about Planck's insight. I believe that our children, and our children's children, will laugh at the concept of trusting central bankers with their money. It is these old guard central bankers who refuse to accept the new reality. It isn't that they don't understand bitcoin, I believe they do. It is that bitcoin forces them to realize that they have wasted their lives promoting a world that runs on fiat money. This is what they really hate.

Disclaimer: This is not investment advice.

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Max Planck

As we see central bankers throw out disparaging remarks concerning bitcoin, I would encourage you to think about Planck's insight. I believe that our children, and our children's children, will laugh at the concept of trusting central bankers with their money. It is these old guard central bankers who refuse to accept the new reality. It isn't that they don't understand bitcoin, I believe they do. It is that bitcoin forces them to realize that they have wasted their lives promoting a world that runs on fiat money. This is what they really hate.

Disclaimer: This is not investment advice.

Weaponizing Money

He probably won't be mentioned in the same breath as the cypherpunks or other early bitcoin pioneers, but my guess is that his influence on the bitcoin movement will prove to have been a powerful one. He is Juan Zarate, former deputy national security advisor for combating terrorism.

His contribution was the weaponizing of the dollar via the use of draconian financial embargoes against entire countries. He now worries that bitcoin and other cryptocurrencies may allow countries that the U.S. labels as bad actors a way around these embargoes.

The reality is that such draconian actions will force not only bad actors to think about using alternatives to the dollar in international trade, but it will force many legitimate companies and individuals to explore alternatives as well. China and Russia have already built an alternative to SWIFT payment platform. No doubt that legitimate individuals and companies worldwide are exploring bitcoin in case the U.S. targets their country or their suppliers or customers. The U.S. is proving itself to be a less than reliable partner on the monetary front, and this extends well beyond the debasement argument.

As Nick Szabo, one of the early cypherpunks explains:

The historically recent growth of centralized digital money has resulted in the transformation of money from being a medium of exchange, to many officials viewing it as primarily a medium of law enforcement. This is increasingly making such money more local and less trustworthy.

The U.S. certainly seems intent on destroying the dollar.

Disclaimer: This does not represent investment advice.

His contribution was the weaponizing of the dollar via the use of draconian financial embargoes against entire countries. He now worries that bitcoin and other cryptocurrencies may allow countries that the U.S. labels as bad actors a way around these embargoes.

The reality is that such draconian actions will force not only bad actors to think about using alternatives to the dollar in international trade, but it will force many legitimate companies and individuals to explore alternatives as well. China and Russia have already built an alternative to SWIFT payment platform. No doubt that legitimate individuals and companies worldwide are exploring bitcoin in case the U.S. targets their country or their suppliers or customers. The U.S. is proving itself to be a less than reliable partner on the monetary front, and this extends well beyond the debasement argument.

As Nick Szabo, one of the early cypherpunks explains:

The historically recent growth of centralized digital money has resulted in the transformation of money from being a medium of exchange, to many officials viewing it as primarily a medium of law enforcement. This is increasingly making such money more local and less trustworthy.

The U.S. certainly seems intent on destroying the dollar.

Disclaimer: This does not represent investment advice.

Monday, February 5, 2018

Software is Eating the World

The title here is courtesy of Marc Andreesen, the Founder of both Netscape and VC firm Andreesen, Horowitz. You can read about his reasoning in this 2011 Wall Street Journal editorial.

He is right, software is eating the world. The editorial runs through a laundry list of industries being upended by software. Today, there is little surprise about this. The one industry Andreesen failed to mention in that early article that would be upended by software was money. This was just a momentary oversight on his part as he and his firm have become vocal proponents of bitcoin, blockchain and crypto.

Andreesen ends the editorial with the following:

Instead of constantly questioning their valuations, let's seek to understand how the new generation of technology companies are doing what they do, what the broader consequences are for businesses and the economy and what we can collectively do to expand the number of innovative software companies created in the U.S. and around the world.

That's the big opportunity. I know where I am putting my money.

Wise advice, and there is no bigger opportunity for software to attack than the industry known as money.

He is right, software is eating the world. The editorial runs through a laundry list of industries being upended by software. Today, there is little surprise about this. The one industry Andreesen failed to mention in that early article that would be upended by software was money. This was just a momentary oversight on his part as he and his firm have become vocal proponents of bitcoin, blockchain and crypto.

Andreesen ends the editorial with the following:

Instead of constantly questioning their valuations, let's seek to understand how the new generation of technology companies are doing what they do, what the broader consequences are for businesses and the economy and what we can collectively do to expand the number of innovative software companies created in the U.S. and around the world.

That's the big opportunity. I know where I am putting my money.

Wise advice, and there is no bigger opportunity for software to attack than the industry known as money.

Disclaimer: This isn't investment advice. In fact, I discourage most from investing in gold and bitcoin because most do not have the tensile strength to take on the existing players and governments. It is very risky.

It is Going to be a Bloodbath

There was a time when I scoffed at bitcoin and some of the lofty price predictions people threw around. No longer.

Central bank debasement has forced financial asset prices to ridiculous extremes and destroyed fiat currency's legitimacy. This is creating multiple effects that will continue for years:

1) Silicon Valley cannot ignore the magnitude of the financial markets. In rough numbers, the tech world believes they now have the tools in bitcoin and crypto to go after markets that dwarf anything they have ever seen. Perhaps as much as $10 trillion in negative yielding bonds, $8 trillion in gold, $20 trillion in fiat paper and as much as $50-70 trillion in M2. They will never go away, they will not flag and they will not tire in pursuit of such monumental sums. The current financial system has a giant bullseye painted on it courtesy of irresponsible central bank debasement.

2) The existing financial system made a deal with the devil and is now destined to lose to Silicon Valley. They bet everything on government. They trusted central banks who, via an out of control policy of debasement, forced the existing financial system to make poor decisions regarding deployment of their capital. Bubbles followed by massive losses culminating in a soft government takeover of the financial system followed by more bubbles were the result. They are hamstrung and must now play the game against far more entrepreneurial and motivated players from the West Coast. It is the existing financial system run by the government vs. ASICS, bitcoin, bandwidth, crypto and programming talent....It is going to be a bloodbath.

The financial establishment will beg the government for help via more regulations on bitcoin, on that there can be little doubt. It won't matter because the existing players made their deal with the devil. They must play the game with the coin of the realm, fiat. There will be no escaping that. It is also their death warrant. Debasement is now permanent, the cost of operating in the fiat realm will now always increase. This will weaken the financial establishment while bitcoin's army from Silicon Valley will grow stronger by the day. Time is on bitcoin's side.

Central bank debasement has forced financial asset prices to ridiculous extremes and destroyed fiat currency's legitimacy. This is creating multiple effects that will continue for years:

1) Silicon Valley cannot ignore the magnitude of the financial markets. In rough numbers, the tech world believes they now have the tools in bitcoin and crypto to go after markets that dwarf anything they have ever seen. Perhaps as much as $10 trillion in negative yielding bonds, $8 trillion in gold, $20 trillion in fiat paper and as much as $50-70 trillion in M2. They will never go away, they will not flag and they will not tire in pursuit of such monumental sums. The current financial system has a giant bullseye painted on it courtesy of irresponsible central bank debasement.

2) The existing financial system made a deal with the devil and is now destined to lose to Silicon Valley. They bet everything on government. They trusted central banks who, via an out of control policy of debasement, forced the existing financial system to make poor decisions regarding deployment of their capital. Bubbles followed by massive losses culminating in a soft government takeover of the financial system followed by more bubbles were the result. They are hamstrung and must now play the game against far more entrepreneurial and motivated players from the West Coast. It is the existing financial system run by the government vs. ASICS, bitcoin, bandwidth, crypto and programming talent....It is going to be a bloodbath.

The financial establishment will beg the government for help via more regulations on bitcoin, on that there can be little doubt. It won't matter because the existing players made their deal with the devil. They must play the game with the coin of the realm, fiat. There will be no escaping that. It is also their death warrant. Debasement is now permanent, the cost of operating in the fiat realm will now always increase. This will weaken the financial establishment while bitcoin's army from Silicon Valley will grow stronger by the day. Time is on bitcoin's side.

Disclaimer: Nothing here should be construed as investment advice. These are nothing but my rambling thoughts. I do own gold and bitcoin, but do not recommend these assets for others. You have to do your own homework and know what you are getting into. Governments hate these two assets and will try to make sure no one who owns these things wins. You have been warned to stay away!

Eagles Beat Patriots

It was a great Super Bowl as the upstart Eagles took down the dynastic New England Patriots and their 40 year old quarterback, Tom Brady. Sure, Brady had another typical year and Super Bowl where he displayed why he is one of the greatest players in NFL history, but time marches on.

The Pats may win a few more Super Bowls before the Brady-Bellichick era is done, but it will end. Pats fans know it, and the rest of the NFL can't wait for it to happen. We can revel in what they have accomplished and be awed by their achievement of staying at the top for so long, but we will someday have to say goodbye.

The same is true for the dollar as the world's reserve currency. The Fed and the rest of the world's central banks have inflicted too much damage on fiat currencies for them to be able to continue their run as the base of the global financial system. Fiat debasement is now a requirement. Regardless of recent price action, the dollar will weaken into the future while bitcoin strengthens. There is no way around this. Like the Pats and Tom Brady, there will still be occasional glimpses of the old glory, but fiat's decline and fall is on the way.

The Pats may win a few more Super Bowls before the Brady-Bellichick era is done, but it will end. Pats fans know it, and the rest of the NFL can't wait for it to happen. We can revel in what they have accomplished and be awed by their achievement of staying at the top for so long, but we will someday have to say goodbye.

The same is true for the dollar as the world's reserve currency. The Fed and the rest of the world's central banks have inflicted too much damage on fiat currencies for them to be able to continue their run as the base of the global financial system. Fiat debasement is now a requirement. Regardless of recent price action, the dollar will weaken into the future while bitcoin strengthens. There is no way around this. Like the Pats and Tom Brady, there will still be occasional glimpses of the old glory, but fiat's decline and fall is on the way.

Disclaimer: Nothing here should be construed as investment advice. These are nothing but my rambling thoughts. I do own gold and bitcoin, but do not recommend these assets for others. You have to do your own homework and know what you are getting into. Governments hate these two assets and will try to make sure no one who owns these things wins. You have been warned to stay away!

Friday, February 2, 2018

The Fiat Building is on Fire!

A couple of days ago I bashed Nobel laureate Paul Krugman for his silly view that the blockchain, as yet, wasn't good for anything. Additionally, he thought that cold fusion was likely to happen before a real use case emerged.

The counterpoint is that the bitcoin use case allows us to avoid having to deal with the never ending debasement of fiat currencies. This morning, the head of the Bank of Japan said that he would buy an unlimited amount of ten year bonds at 11 basis points. At 11 basis points the head of the BOJ is so terrified about the state of the Japanese financial system that he is willing to unleash an infinite amount of newly created yen to keep ten year rates at stupidly low levels. This is suicidal. If this doesn't convince you that there is no way out of this mess, then nothing will.

Bitcoin isn't just the most elegant, decentralized and immutable accounting system for value that has ever emerged, it has emerged at precisely that moment in time that the world's central bankers are trapped. They must either incinerate their currencies, or incinerate their financial markets. The building built by fiat money is on fire and they want to trap us all inside. Bitcoin is the way out.

The counterpoint is that the bitcoin use case allows us to avoid having to deal with the never ending debasement of fiat currencies. This morning, the head of the Bank of Japan said that he would buy an unlimited amount of ten year bonds at 11 basis points. At 11 basis points the head of the BOJ is so terrified about the state of the Japanese financial system that he is willing to unleash an infinite amount of newly created yen to keep ten year rates at stupidly low levels. This is suicidal. If this doesn't convince you that there is no way out of this mess, then nothing will.

Bitcoin isn't just the most elegant, decentralized and immutable accounting system for value that has ever emerged, it has emerged at precisely that moment in time that the world's central bankers are trapped. They must either incinerate their currencies, or incinerate their financial markets. The building built by fiat money is on fire and they want to trap us all inside. Bitcoin is the way out.

Disclaimer: Nothing here should be construed as investment advice. These are nothing but my rambling thoughts. I do own gold and bitcoin, but do not recommend these assets for others. You have to do your own homework and know what you are getting into. Governments hate these two assets and will try to make sure no one who owns these things wins. You have been warned to stay away!

Subscribe to:

Posts (Atom)