Wednesday, April 11, 2018

Fear Centralization....of Anything

https://twitter.com/SteveFranssen/status/980225137403314176

Monday, April 9, 2018

Taxes and bitcoin

I am a little surprised at myself for not thinking through the tax implications of last year's massive increase in the bitcoin price. They are massive, and they have almost certainly put more downward pressure on the bitcoin price than my lone gunman theory.

In this article, bitcoin bull Tom Lee estimates that U.S. investors are on the hook for about $25 billion in taxes for their crypto gains last year.

This is an enormous amount of pressure to be placed on the rather illiquid market and it has certainly impacted price. Yes, we will still have to deal with the Mt. Gox trustee and his overhang, but if tax selling has been the main contributor to the bitcoin bear market, we should know relatively soon as April, 17th is tax filing day in the U.S.

Notice: This is not to be taken as investment advice.

In this article, bitcoin bull Tom Lee estimates that U.S. investors are on the hook for about $25 billion in taxes for their crypto gains last year.

This is an enormous amount of pressure to be placed on the rather illiquid market and it has certainly impacted price. Yes, we will still have to deal with the Mt. Gox trustee and his overhang, but if tax selling has been the main contributor to the bitcoin bear market, we should know relatively soon as April, 17th is tax filing day in the U.S.

Notice: This is not to be taken as investment advice.

Friday, April 6, 2018

Institutional Investors on the Way?

There are reports out this morning that George Soros' family office is ready to start trading digital currencies. This may be a sign that there is enough confidence in the institutional custody arrangements on offer for the institutional community to wade into the sector. This is Soros' family office however, and they may not be required to have the strong custody arrangements required of hedge funds given that they do not manage money for outsiders. My guess is that Soros isn't going to let some underling run around with a bunch of his money on a Trezor, so he must be satisfied with the custody issues.

Nevertheless, the bear market began due to the emergence of our lone gunman and the delay in the expected wave of institutional money. Progress on the institutional custody front should help to turn the tide.

Notice: This does not constitute investment advice.

Nevertheless, the bear market began due to the emergence of our lone gunman and the delay in the expected wave of institutional money. Progress on the institutional custody front should help to turn the tide.

Notice: This does not constitute investment advice.

Thursday, April 5, 2018

The Lone Gunman of 2014

Trace Mayer, an early bitcoin convert, developed a ratio that he has used to describe frothiness or lack of interest in the bitcoin market. It is a simple ratio, the current price divided by bitcoin's 200 day moving average price.

Currently, the 200 day moving average (DMA) is $9455 and the current Mayer Multiple is 0.73 (source: https://twitter.com/tipmayermultple?lang=en). The Mayer Multiple has historically been higher more than 90% of the time throughout bitcoin's history.

An asset that appreciates in dollar terms over time will, on average, trade above the 200 DMA. For those who believe that bitcoin's monetary properties are vastly superior to those of fiat and the dollar, today's price seems like quite the bargain.

While bitcoin's history is relatively brief, it is worth our time to look at the only other extended period of time when the Mayer Multiple was at current levels.

Bitcoin sprang into existence in January of 2009 and never had a price above $1 until early in 2011. The 200 DMA then didn't really start to have any meaning then until 2012. The following graph hasn't been updated since February 5, 2018:

source: https://www.theinvestorspodcast.com/bitcoin-mayer-multiple/

source: https://www.theinvestorspodcast.com/bitcoin-mayer-multiple/

Currently, the 200 day moving average (DMA) is $9455 and the current Mayer Multiple is 0.73 (source: https://twitter.com/tipmayermultple?lang=en). The Mayer Multiple has historically been higher more than 90% of the time throughout bitcoin's history.

An asset that appreciates in dollar terms over time will, on average, trade above the 200 DMA. For those who believe that bitcoin's monetary properties are vastly superior to those of fiat and the dollar, today's price seems like quite the bargain.

While bitcoin's history is relatively brief, it is worth our time to look at the only other extended period of time when the Mayer Multiple was at current levels.

Bitcoin sprang into existence in January of 2009 and never had a price above $1 until early in 2011. The 200 DMA then didn't really start to have any meaning then until 2012. The following graph hasn't been updated since February 5, 2018:

source: https://www.theinvestorspodcast.com/bitcoin-mayer-multiple/

source: https://www.theinvestorspodcast.com/bitcoin-mayer-multiple/

Since publication, the Mayer Multiple has continued to fall. We can also see that the Mayer Multiple traded below 1.0 between early 2014 and the middle of 2015.

So, what was happening in the bitcoin world back then? In short, it seemed like the end of bitcoin to many. Silk Road, the online drug emporium, had been seized by the US government and its operator arrested. Also, Mt. Gox, at one time the largest bitcoin exchange went bankrupt.

Bitcoin skeptics claimed bitcoin was only good for illicit purposes and the Mt.Gox' collapse made it difficult to establish a real bitcoin price. The real problem for bitcoin however, was the overhang of coins for sale. The US government confiscated 144,000 bitcoins in the Silk Road case and auctioned them off between June of 2014 and November of 2015.

The government then had for sale about one percent of all bitcoins in circulation. Given that prices are set at the margin and bitcoin holders are very short term in nature, bitcoin's price was under pressure while the overhang existed.

Today, the Mt. Gox trustee has sold 40k bitcoins and currently has a little less than one percent of all bitcoins available for liquidation. To me, the parallel of today's price pressure to the Silk Road case is obvious.

What is different however, is that bitcoin is far more entrenched today than in 2014 and its main use case, an escape from central banker dishonesty, is now well established. 2014-15 was an opportune time to acquire bitcoin and I suspect history will repeat itself in time.

Notice: This does not constitute investment advice. I cannot know your financial situation and whether these discussions are therefore, relevant.

Wednesday, April 4, 2018

Lone Gunman Fires Off a Couple More Rounds

Early in the morning in the U.S., Mark Karpeles, former head of Mt.Gox the now bankrupt bitcoin exchange, started posting on Reddit. He was there answering questions and we saw his response to a question about the Mt. Gox liquidation:

Question: According to Japanese law, to be able to process the Mt. Gox bankruptcy, trustee Kobayashi has to sell assets (BTC, BCH, BCG) and convert them to Japanese yen. Is that correct?

Karpeles: Yes, this is correct. Actually, this applies to most jurisdictions, bankruptcy means a liquidator is appointed to investigate assets and liquidate them, ie. sell everything.

With that, bitcoin headed down nine percent for the day. Perhaps there had been hope that the trustee would distribute bitcoins to the creditors instead of liquidating them for yen.

Since I posted my lone gunman theory, I have believed that the Mt. Gox bankruptcy liquidation has been the key driver of the bitcoin correction. This morning's price action didn't get me to change my mind.

It is true that bitcoin ran very hard in December on the belief that institutional money was going to come into the bitcoin trade in 2018. This has not happened due to the lack of infrastructure in place for these investors and this has also been part of the problem. Finally, the average holding period for bitcoin is only about ten days. That is, most investors who trade bitcoin do not care about its growing dominance in the field, its decentralized nature, its immutability or its capabilities as the best ledger and accounting system for value. They only care about direction and momentum, and the massive Mt. Gox seller has flipped momentum to the downside.

Cleaning up the Gox trustee here is the key, in my opinion, for the next leg of the bitcoin bull market. The institutional market is coming along, just more slowly than anticipated. If one looks at the depth of the bids in the market now, the bids are starting to massively outweigh the offers. Hopefully, bitcoin finds its bottom down here in the same range as we saw with the early February drop.

Nevertheless, I don't believe that bitcoin's price decline has been fundamentally driven.

Notice: This does not represent investment advice. These are only my opinions and I have no idea if bitcoin will work as an investment.

Question: According to Japanese law, to be able to process the Mt. Gox bankruptcy, trustee Kobayashi has to sell assets (BTC, BCH, BCG) and convert them to Japanese yen. Is that correct?

Karpeles: Yes, this is correct. Actually, this applies to most jurisdictions, bankruptcy means a liquidator is appointed to investigate assets and liquidate them, ie. sell everything.

With that, bitcoin headed down nine percent for the day. Perhaps there had been hope that the trustee would distribute bitcoins to the creditors instead of liquidating them for yen.

Since I posted my lone gunman theory, I have believed that the Mt. Gox bankruptcy liquidation has been the key driver of the bitcoin correction. This morning's price action didn't get me to change my mind.

It is true that bitcoin ran very hard in December on the belief that institutional money was going to come into the bitcoin trade in 2018. This has not happened due to the lack of infrastructure in place for these investors and this has also been part of the problem. Finally, the average holding period for bitcoin is only about ten days. That is, most investors who trade bitcoin do not care about its growing dominance in the field, its decentralized nature, its immutability or its capabilities as the best ledger and accounting system for value. They only care about direction and momentum, and the massive Mt. Gox seller has flipped momentum to the downside.

Cleaning up the Gox trustee here is the key, in my opinion, for the next leg of the bitcoin bull market. The institutional market is coming along, just more slowly than anticipated. If one looks at the depth of the bids in the market now, the bids are starting to massively outweigh the offers. Hopefully, bitcoin finds its bottom down here in the same range as we saw with the early February drop.

Nevertheless, I don't believe that bitcoin's price decline has been fundamentally driven.

Notice: This does not represent investment advice. These are only my opinions and I have no idea if bitcoin will work as an investment.

Tuesday, April 3, 2018

Crashing US Savings Rate Portends End of Dollar as Reserve Currency

I have documented the relationship between savings, growth and household net worth here and here. I bring this up because the latest net national savings rate for the U.S. shows a savings rate of just 1.3% of gross national income (GNI is just slightly different from GDP). Savings is the driver of both growth and wealth creation. If one judges by the increase in US household net worth over the past couple of decades, it would seem as if the U.S. is creating wealth like crazy, maybe amounting to 25% of GDP per year over the period. This figure hit 35% last year.

The problem is that GDP growth and savings amount to only a small fraction of the wealth creation numbers, and over time these must be equal. Perhaps just one fifth of wealth creation in the US has been backed up with savings and output growth over the past two decades. In short, the dollar isn't backed up by enough goods and services.

There is a paradox that results from one country issuing the reserve currency, it will become overvalued. This happens because people outside the country that issues the reserve currency will want to hold some, driving up its value. This will make businesses in the reserve issuing country uncompetitive. Recession will follow. To fight this, the Fed always prints new money and drives down interest rates. This has the perverse effect of pushing the savings rate down even further while driving up asset prices. We can see by looking at the graphs showing the secular crash in savings versus the massive levitation of net worth. This makes no sense. The gap between savings + growth and net worth gets ever larger. The dollar is a bad bet as there are few resources to back up all of the claims that dollar holders possess.

It has been clear to me for years (see here) that the Ponzi type structure of the dollar combined with the weaponization of money would lead China and Russia to attack the dollar's reserve status. Well, China isn't even couching their language any longer. Zerohedge reports:

The Global Times, the unofficial mouthpiece of the Chinese government, printed a remarkable story from one of its editors highlighting the petroyuan and its potential to topple the US dollar as the global reserve currency.

The ledger associated with the dollar is completely broken, and China and Russia understand this. Bitcoin (and to a lesser extent gold) is a better ledger of value (money) than the dollar and other fiat currencies and should benefit.

Notice: This is not investment advice. These are solely my opinions and they may be wrong.

The problem is that GDP growth and savings amount to only a small fraction of the wealth creation numbers, and over time these must be equal. Perhaps just one fifth of wealth creation in the US has been backed up with savings and output growth over the past two decades. In short, the dollar isn't backed up by enough goods and services.

There is a paradox that results from one country issuing the reserve currency, it will become overvalued. This happens because people outside the country that issues the reserve currency will want to hold some, driving up its value. This will make businesses in the reserve issuing country uncompetitive. Recession will follow. To fight this, the Fed always prints new money and drives down interest rates. This has the perverse effect of pushing the savings rate down even further while driving up asset prices. We can see by looking at the graphs showing the secular crash in savings versus the massive levitation of net worth. This makes no sense. The gap between savings + growth and net worth gets ever larger. The dollar is a bad bet as there are few resources to back up all of the claims that dollar holders possess.

It has been clear to me for years (see here) that the Ponzi type structure of the dollar combined with the weaponization of money would lead China and Russia to attack the dollar's reserve status. Well, China isn't even couching their language any longer. Zerohedge reports:

The Global Times, the unofficial mouthpiece of the Chinese government, printed a remarkable story from one of its editors highlighting the petroyuan and its potential to topple the US dollar as the global reserve currency.

The ledger associated with the dollar is completely broken, and China and Russia understand this. Bitcoin (and to a lesser extent gold) is a better ledger of value (money) than the dollar and other fiat currencies and should benefit.

Notice: This is not investment advice. These are solely my opinions and they may be wrong.

Sunday, April 1, 2018

If it's Centralized, it's Probably Corrupted

Watching the Facebook saga play out over the past few weeks highlights all of my previous posts about the centralization of information. Facebook rose to the the top of the social networking space by offering itself as the "trusted" network where only your vetted friends were allowed access. Facebook, like nearly everything that is centralized, was not to be trusted.

Now there are demands to regulate Facebook and other social media, but whom to trust as the regulator? I certainly don't want government in charge. I am not sure how the giant information silos will adapt to the new environment, but I am sure that blockchain, tokens and cryptography will provide entrepreneurs the tools required to offer people a better way to control and share their information.

With government, information and money and banking we should assume that centralization means corruption in some form.

Thursday, March 29, 2018

The Pit in Your Stomach

Bitcoin is down 15% in the last 24 hours to $6786. It is should be nerve shattering to a bitcoin bull, but this isn't.

This is not going to be a post about anything rational, it is a post about a feeling.

I have not led a life out of the ordinary. I am middle-aged, married, two adult children. There have been no events in my life that Steven Spielberg would want to shoot as a feature film. Nothing that I have done would anyone describe as heroic. No great tragedy has befallen me that required a herculean effort at recovery.

I have made some tough and very good secular calls as an investor. Long tech in the early 1990s. Exiting tech in 1999. Buying gold in 2000.

There has also been the pain of being very long gold for the past six years.

Again, nothing too out of the ordinary. What I want to talk about here are the biggest decisions of my life and how unsettling they may have been at the time, but how awesome they were as I look back at them. I am talking about getting married and having kids.

If you were lucky, you grew up inside a great family and with parents who set a good example, but nothing can really prepare you for having to play out the events yourself. If anyone really knew beforehand what it took to make a marriage work, or what you would sacrifice for your kids, then I am sure that there would be fewer marriages and fewer kids.

The leap into that unknown was, for me, completely worth it, however. Somehow, we as humans instinctively know this. We know there are risks, but do it anyway, and it is awesome....even the scary parts.

This is how I feel now about bitcoin. Sure, my wife will hate reading this, comparing her to a bunch of code written by some pseudonymous programmer may not make her feel too great, but I hope she sees it as I see her and bitcoin...as miracles.

Bitcoin is one of the great achievements of man in my opinion. A true miracle. Something that can solve many of the problems of economics and justice that have bothered me for years. Yes, like my wife, bitcoin is a miracle, perhaps even a gift from God.

Yes, I feel bitcoin is that important. No, I am not going to assure you that bitcoin will work out. It may not. There are plenty of powerful forces arrayed against it, and they may yet win out.

I am saying that I don't care, I just want to be a part of it. Like meeting my wife for the first time, I wasn't quite sure where it was going, I just knew that I wanted to be partnered with her. Many marriages don't work out, but people still get married because what may happen is too wonderful miss out on.

That is bitcoin to me. The best ledger, the best unit of account, the best accounting system for value the world has ever seen. This is the one investment that I am willing to fight for because I think it is the one thing that I have seen in all my years that should make the world a better place. It is a revolution in money, morality and opportunity. Maybe the best investments should generate that same spark that befalls you when you meet your spouse. Perhaps we humans should instinctively know these things about investing. Perhaps we get too caught up in the fear, uncertainty and doubt and let ourselves be frightened away from the great opportunities we see. Bitcoin, if it works, would be too wonderful to miss out on.

I just feel I need to be partnered up with this one for the duration.

Disclosure: This does not represent investment or marriage advice. I can't possibly know what is the right thing for you to do.

This is not going to be a post about anything rational, it is a post about a feeling.

I have not led a life out of the ordinary. I am middle-aged, married, two adult children. There have been no events in my life that Steven Spielberg would want to shoot as a feature film. Nothing that I have done would anyone describe as heroic. No great tragedy has befallen me that required a herculean effort at recovery.

I have made some tough and very good secular calls as an investor. Long tech in the early 1990s. Exiting tech in 1999. Buying gold in 2000.

There has also been the pain of being very long gold for the past six years.

Again, nothing too out of the ordinary. What I want to talk about here are the biggest decisions of my life and how unsettling they may have been at the time, but how awesome they were as I look back at them. I am talking about getting married and having kids.

If you were lucky, you grew up inside a great family and with parents who set a good example, but nothing can really prepare you for having to play out the events yourself. If anyone really knew beforehand what it took to make a marriage work, or what you would sacrifice for your kids, then I am sure that there would be fewer marriages and fewer kids.

The leap into that unknown was, for me, completely worth it, however. Somehow, we as humans instinctively know this. We know there are risks, but do it anyway, and it is awesome....even the scary parts.

This is how I feel now about bitcoin. Sure, my wife will hate reading this, comparing her to a bunch of code written by some pseudonymous programmer may not make her feel too great, but I hope she sees it as I see her and bitcoin...as miracles.

Bitcoin is one of the great achievements of man in my opinion. A true miracle. Something that can solve many of the problems of economics and justice that have bothered me for years. Yes, like my wife, bitcoin is a miracle, perhaps even a gift from God.

Yes, I feel bitcoin is that important. No, I am not going to assure you that bitcoin will work out. It may not. There are plenty of powerful forces arrayed against it, and they may yet win out.

I am saying that I don't care, I just want to be a part of it. Like meeting my wife for the first time, I wasn't quite sure where it was going, I just knew that I wanted to be partnered with her. Many marriages don't work out, but people still get married because what may happen is too wonderful miss out on.

That is bitcoin to me. The best ledger, the best unit of account, the best accounting system for value the world has ever seen. This is the one investment that I am willing to fight for because I think it is the one thing that I have seen in all my years that should make the world a better place. It is a revolution in money, morality and opportunity. Maybe the best investments should generate that same spark that befalls you when you meet your spouse. Perhaps we humans should instinctively know these things about investing. Perhaps we get too caught up in the fear, uncertainty and doubt and let ourselves be frightened away from the great opportunities we see. Bitcoin, if it works, would be too wonderful to miss out on.

I just feel I need to be partnered up with this one for the duration.

Disclosure: This does not represent investment or marriage advice. I can't possibly know what is the right thing for you to do.

Tuesday, March 27, 2018

CBOE Recommends SEC Approve bitcoin ETFs

We are going to revisit the Lone Gunman Theory of bitcoin where I posited that, given the delayed uptake on the part of institutional investors in the crypto space and the very short term trading nature of most holders, that the Mt. Gox seller was largely responsible for the decline in bitcoin's price.

My hope is that he can be cleaned up quickly. One option would be to have a small number of Silicon Valley based buyers buy the coins. The other option would be a rapid increase institutional investors in bitcoin.

The latter option will eventually happen. Wall Street is coming, we just have to await the infrastructure they need to be put into place. There was some movement on that front yesterday as the CBOE recommends that the SEC allow bitcoin ETFs.

When ETFs happen in this space, it will be a major game changer as it will allow trillions of dollars at investment firms to buy bitcoin for the first time. Timing is still uncertain, but we are moving in that direction. The Bitcoin Investment Trust (GBTC) trades at more than a 50% premium to the underlying value of the bitcoins held by the trust. I think that most people assume that the premium will disappear upon the announcement of an approval of a real bitcoin ETF. I would also assume that the premium disappears because bitcoin rises in price and not because GBTC will collapse.

Notice: This is not investment advice.

My hope is that he can be cleaned up quickly. One option would be to have a small number of Silicon Valley based buyers buy the coins. The other option would be a rapid increase institutional investors in bitcoin.

The latter option will eventually happen. Wall Street is coming, we just have to await the infrastructure they need to be put into place. There was some movement on that front yesterday as the CBOE recommends that the SEC allow bitcoin ETFs.

When ETFs happen in this space, it will be a major game changer as it will allow trillions of dollars at investment firms to buy bitcoin for the first time. Timing is still uncertain, but we are moving in that direction. The Bitcoin Investment Trust (GBTC) trades at more than a 50% premium to the underlying value of the bitcoins held by the trust. I think that most people assume that the premium will disappear upon the announcement of an approval of a real bitcoin ETF. I would also assume that the premium disappears because bitcoin rises in price and not because GBTC will collapse.

Notice: This is not investment advice.

Wednesday, March 21, 2018

More News From Silicon Valley

It is no secret that that the vast centralized information silos of Google and Facebook have scooped up a very large share of all of the net value that has so far accrued to internet companies. There is real pushback developing against this, however. Recently, Edward Snowden said that Facebook wasn't a social media company, but a surveillance company. The Cambridge Analytica scandal is making this observation widely known. Centralization of information is a major problem.

In what I take to be a very astonishing development, the cofounder of WhatsApp, a messaging service that was sold to Facebook for $19 billion, has told his Twitter followers to delete Facebook.

The centralization of so much personal data and the incentive this gives to Facebook to exploit that data highlights the risk of centralization. Perhaps we are reaching a tipping point on this front. The embrace of decentralization is coming. ASICS, cryptography, software and blockchain make real decentralization possible for the first time. I doubt that will be bad for bitcoin.

Disclosure: This is not investment advice.

In what I take to be a very astonishing development, the cofounder of WhatsApp, a messaging service that was sold to Facebook for $19 billion, has told his Twitter followers to delete Facebook.

The centralization of so much personal data and the incentive this gives to Facebook to exploit that data highlights the risk of centralization. Perhaps we are reaching a tipping point on this front. The embrace of decentralization is coming. ASICS, cryptography, software and blockchain make real decentralization possible for the first time. I doubt that will be bad for bitcoin.

Disclosure: This is not investment advice.

Silicon Valley Going All in on BTC

Jack Dorsey, founder of Twitter and Square:

https://twitter.com/TuurDemeester/status/976504382719176706

Disclosure: This is not investment advice.

https://twitter.com/TuurDemeester/status/976504382719176706

Disclosure: This is not investment advice.

Was There a Bubble in bitcoin?

Bitcoin peaked in December at nearly $20,000, but by early February its price had fallen 70% to around $6,000. Bitcoin skeptics were quick to claim that they had been correct about calling bitcoin a bubble, even if they had been doing so since before it had reached $1000. Yes, Paul Krugman, I am speaking about you.

So, was bitcoin in bubble territory?

There have been many articles on the topic, but one of the more interesting ones appeared yesterday at Coindesk. Their conclusion, it was a bubble, but that the bubble was a good thing. Bubbles, you see, lead to technological progress and the build out of infrastructure that eventually leads us to the promised land. From Coindesk:

One way to look at the current bubble is through the lens of Carlota Perez, the Venezuelan theorist who wrote about the interplay between technology and capital markets in an influential book called "Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages." She concluded that bubbles - and their inevitable collapse - are an integral, in fact necessary, part of the economic dynamics through which transformational technologies take root in society.

This view means that technological progress requires a bubble.

Perhaps this is true to some degree for most technologies. As an Austrian however, I view the scale of the bubbles of recent decades very differently than the enthusiasm for a new technology of which Perez speaks. These recent and enormous bubbles have been driven by excessive central bank money printing and the socialization of losses (bailouts). We need to be careful to recognize the difference.

It is clear that Satoshi meant to point the dagger of bitcoin directly at the heart of central bank and government fostered bubbles and theft. In fact, the bitcoin genesis block contained the following message:

03/Jan/2009 Chancellor on brink of second bailout for banks

It is clear that bitcoin's deployment into the financial wild on that day was a response to the interference of governments in finance and economics and the boom-bust cycle that they have caused. That is, bitcoin is intended as medicine for Bubble Disease, a potential cure. As such, bitcoin's price represents its effectiveness in this effort and cannot itself be a bubble. The medicine is either working at a particular point in time (bitcoin's price is rising), or its effect on the disease is weakening (bitcoin's price is falling).

I recall a line that was popular a few months ago, bitcoin isn't the bubble, it's the pin. I agree with this. There have been plenty of other periods when bitcoin's medicine seemed to be losing its potency, but it has always reemerged more efficacious than ever. I expect a repeat of this.

Disclaimer: This is not investment advice, solely the opinion of someone who is currently losing money.

So, was bitcoin in bubble territory?

There have been many articles on the topic, but one of the more interesting ones appeared yesterday at Coindesk. Their conclusion, it was a bubble, but that the bubble was a good thing. Bubbles, you see, lead to technological progress and the build out of infrastructure that eventually leads us to the promised land. From Coindesk:

One way to look at the current bubble is through the lens of Carlota Perez, the Venezuelan theorist who wrote about the interplay between technology and capital markets in an influential book called "Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages." She concluded that bubbles - and their inevitable collapse - are an integral, in fact necessary, part of the economic dynamics through which transformational technologies take root in society.

This view means that technological progress requires a bubble.

Perhaps this is true to some degree for most technologies. As an Austrian however, I view the scale of the bubbles of recent decades very differently than the enthusiasm for a new technology of which Perez speaks. These recent and enormous bubbles have been driven by excessive central bank money printing and the socialization of losses (bailouts). We need to be careful to recognize the difference.

It is clear that Satoshi meant to point the dagger of bitcoin directly at the heart of central bank and government fostered bubbles and theft. In fact, the bitcoin genesis block contained the following message:

03/Jan/2009 Chancellor on brink of second bailout for banks

It is clear that bitcoin's deployment into the financial wild on that day was a response to the interference of governments in finance and economics and the boom-bust cycle that they have caused. That is, bitcoin is intended as medicine for Bubble Disease, a potential cure. As such, bitcoin's price represents its effectiveness in this effort and cannot itself be a bubble. The medicine is either working at a particular point in time (bitcoin's price is rising), or its effect on the disease is weakening (bitcoin's price is falling).

I recall a line that was popular a few months ago, bitcoin isn't the bubble, it's the pin. I agree with this. There have been plenty of other periods when bitcoin's medicine seemed to be losing its potency, but it has always reemerged more efficacious than ever. I expect a repeat of this.

Disclaimer: This is not investment advice, solely the opinion of someone who is currently losing money.

More on Bloomberg's Excellent Point

Bloomberg hit upon a very important point here which I posted in my last article and needs to be expanded upon:

The fact that Bitcoin was designed to confound human decision-making is a feature, not a flaw. The core protocol is tasked with enforcing the single rule most crucial to the cryptocurrency’s value: no counterfeit spending. By contrast, the U.S. dollar is burdened with effecting monetary policy, enforcing sanctions, fighting crime and much more. The more functions a currency has, the more things there are to argue over, and the more likely the community will be to fracture. Bitcoin’s uncompromising focus allows it to serve a broader user base.

TAI: It really is quite amazing what the U.S. expects to be able to do with the dollar. Yes, monetary policy, spying on people, fighting (supposed) crime and enforcing sanctions, but also bailing out banks, propping up financial markets, reducing unemployment and funding budget deficits.

Weaponized money has already pushed China and Russia to build an alternative to SWIFT and has fostered a fair amount of gold buying by these two. Asking the dollar to do so much compromises its ability to function as a trusted store of value, a trusted medium of exchange and a trusted unit of account.

Gold and bitcoin have no such obligations and are therefore, far more trustworthy as money.

Disclosure: This does not represent any form of investment advice.

The fact that Bitcoin was designed to confound human decision-making is a feature, not a flaw. The core protocol is tasked with enforcing the single rule most crucial to the cryptocurrency’s value: no counterfeit spending. By contrast, the U.S. dollar is burdened with effecting monetary policy, enforcing sanctions, fighting crime and much more. The more functions a currency has, the more things there are to argue over, and the more likely the community will be to fracture. Bitcoin’s uncompromising focus allows it to serve a broader user base.

TAI: It really is quite amazing what the U.S. expects to be able to do with the dollar. Yes, monetary policy, spying on people, fighting (supposed) crime and enforcing sanctions, but also bailing out banks, propping up financial markets, reducing unemployment and funding budget deficits.

Weaponized money has already pushed China and Russia to build an alternative to SWIFT and has fostered a fair amount of gold buying by these two. Asking the dollar to do so much compromises its ability to function as a trusted store of value, a trusted medium of exchange and a trusted unit of account.

Gold and bitcoin have no such obligations and are therefore, far more trustworthy as money.

Disclosure: This does not represent any form of investment advice.

Wednesday, March 14, 2018

Excellent Point in Bloomberg Article

The fact that Bitcoin was designed to confound human decision-making is a feature, not a flaw. The core protocol is tasked with enforcing the single rule most crucial to the cryptocurrency’s value: no counterfeit spending. By contrast, the U.S. dollar is burdened with effecting monetary policy, enforcing sanctions, fighting crime and much more. The more functions a currency has, the more things there are to argue over, and the more likely the community will be to fracture. Bitcoin’s uncompromising focus allows it to serve a broader user base.

https://www.bloomberg.com/view/articles/2018-03-14/bitcoin-blockchain-demonstrates-the-value-of-anarchy

Disclaimer: This is not investment advice.

https://www.bloomberg.com/view/articles/2018-03-14/bitcoin-blockchain-demonstrates-the-value-of-anarchy

Disclaimer: This is not investment advice.

Find the Inconsistency

"Economist" Larry Kudlow joins the Trump Administration.

White House Looks to Slash China Trade Surplus by $100 billion: Wall Street Journal

Kudlow favors strong dollar, has no reason to believe Trump isn't for one either: CNBC

My only response is that they are really screwing with us now. No one in DC even tries to make any sense.

Disclaimer: This is not investment advice.

White House Looks to Slash China Trade Surplus by $100 billion: Wall Street Journal

Kudlow favors strong dollar, has no reason to believe Trump isn't for one either: CNBC

My only response is that they are really screwing with us now. No one in DC even tries to make any sense.

Disclaimer: This is not investment advice.

Google Ad Ban Rocks Bitcoin, Proves Need for Bitcoin

Within a few hours of Google banning ads for crypto-currencies this morning, the group was down about 10% across the board. While this would have no impact on bitcoin, there is no bitcoin company to authorize any advertising, the market sees it as symptomatic of problems for the sector.

The way the market should see it is as a problem of centralization. Central authorities possess incredible power and can restrict freedom and privacy at their whim. This ad ban, much like Twitter's banning thousands of posters recently, shows how desperate our world is for decentralized systems, systems where speech is free and privacy protected. Google's ad ban highlights the need for decentralized networks like bitcoin.

Disclaimer: This is not investment advice.

Friday, March 9, 2018

Bitcoin and the Lone Gunman Theory

Endless speculation has swirled around the assassination of President John Kennedy. Did Oswald act alone or was he part of a larger conspiracy? It looks like the debate will never end. More than five decades later people debate the facts and the fiction surrounding JFK's death, but no real answer emerges.

Today's post will be much like debating the JFK assassination, lots of speculation, but with no real definitive outcome.

My theory, bitcoin's price fall since its peak in December has been caused by one man, the Lee Harvey Oswald of bitcoin.

The basic plot line follows the story of Mt. Gox. Mt. Gox was the largest bitcoin exchange in the world, responsible for more than 70% of all bitcoin volume several years ago. The exchange lost one million bitcoins and filed for bankruptcy. Subsequently, 200,000 coins were found. Now, years later, the bankruptcy trustee in Japan has begun selling these coins. The revelation of the selling occurred in the past couple of days.

To this point, it appears that the trustee has sold 40,000 coins. Below we can see the dates and quantity of coins moved to an exchange for sale.

It is no coincidence that bitcoin peaked just as he started to sell, and bottomed at around $6000 as he sold his final tranche of 18,000 bitcoins. Graphically, it looks like this:

Source: https://twitter.com/matt_odell/status/971432146656202752

It might seem strange that one of the great technological innovations of our time can be moved down 70% on less than $2 billion of bitcoin overhang, but this is very much part of bitcoin's trading character.

By my estimation, half of all bitcoins never trade. This includes Satoshi's one million coins and the 3-4 million coins that have been estimated to have been lost. This means that nearly all trading occurs among about 8 million bitcoins. Shockingly, given the amount of daily trading volume in bitcoin, these coins turn over every ten days. That is, most investors hold bitcoin for a very short period of time. Much of bitcoin's price momentum is determined by these people. They are not so much interested in the technology as they are in price momentum.

The other thing that drives near-term price is new investors. Last year they came for bitcoin in spades. Now that the upside momentum has been broken, they are standing on the sidelines.

The scary part for investors now is that the trustee has been willing to sell down to the $6000 level and he has only sold one fifth of his available coins. The trustee has been a horrible seller of bitcoin, especially as he knew that he would have to disclose his actions long before he completed his sales. These coins should never have been placed on an exchange for sale. He should have approached Circle or one of the other OTC firms and moved them all at once. Given the short-term nature of so many bitcoin traders, he has now advertised his book, the price at which he is willing to sell and is being front run.

I think it is now clear that one reckless man and very poor trader has tipped bitcoin into a severe bear market.

There is some good news in this, however. We now know what is going on, and while it may appear that he will be able to exert downward pressure on the market for some time, the trustee only has about $1.3 billion in bitcoin left to sell. I expect that bitcoin fans in Silicon Valley and at the larger OTC firms are now working feverishly to put together a group to buy them all.

Personally, I think that Amazon should buy them. As Jeff Bezos says, "Your margin is my opportunity." There is no better way to negotiate with Visa and Mastercard than while holding $1+ billion in bitcoin, the technology that will crush Visa and Mastercard's exorbitant fees. Additionally, Amazon's buying of the last of the Mt. Gox bitcoin would, in my opinion, double bitcoin's price.

This is all rank speculation on my part, but it isn't too hard to connect the dots. Bitcoin's technology continues to advance as Segwit adoption moves ahead and there are now nearly 1000 Lightning Network nodes active. Bitcoin's network has never appeared stronger, while the game theory aspect has pushed Germany to declare bitcoin exempt from capital gains taxes if used to purchase things. As such, bitcoin's most recent bear market may end very soon if we can clean up the sloppy seller.

Disclaimer: This is not to be construed as investment advice.

Today's post will be much like debating the JFK assassination, lots of speculation, but with no real definitive outcome.

My theory, bitcoin's price fall since its peak in December has been caused by one man, the Lee Harvey Oswald of bitcoin.

The basic plot line follows the story of Mt. Gox. Mt. Gox was the largest bitcoin exchange in the world, responsible for more than 70% of all bitcoin volume several years ago. The exchange lost one million bitcoins and filed for bankruptcy. Subsequently, 200,000 coins were found. Now, years later, the bankruptcy trustee in Japan has begun selling these coins. The revelation of the selling occurred in the past couple of days.

To this point, it appears that the trustee has sold 40,000 coins. Below we can see the dates and quantity of coins moved to an exchange for sale.

23 replies150 retweets357 likes

It is no coincidence that bitcoin peaked just as he started to sell, and bottomed at around $6000 as he sold his final tranche of 18,000 bitcoins. Graphically, it looks like this:

Source: https://twitter.com/matt_odell/status/971432146656202752

It might seem strange that one of the great technological innovations of our time can be moved down 70% on less than $2 billion of bitcoin overhang, but this is very much part of bitcoin's trading character.

By my estimation, half of all bitcoins never trade. This includes Satoshi's one million coins and the 3-4 million coins that have been estimated to have been lost. This means that nearly all trading occurs among about 8 million bitcoins. Shockingly, given the amount of daily trading volume in bitcoin, these coins turn over every ten days. That is, most investors hold bitcoin for a very short period of time. Much of bitcoin's price momentum is determined by these people. They are not so much interested in the technology as they are in price momentum.

The other thing that drives near-term price is new investors. Last year they came for bitcoin in spades. Now that the upside momentum has been broken, they are standing on the sidelines.

The scary part for investors now is that the trustee has been willing to sell down to the $6000 level and he has only sold one fifth of his available coins. The trustee has been a horrible seller of bitcoin, especially as he knew that he would have to disclose his actions long before he completed his sales. These coins should never have been placed on an exchange for sale. He should have approached Circle or one of the other OTC firms and moved them all at once. Given the short-term nature of so many bitcoin traders, he has now advertised his book, the price at which he is willing to sell and is being front run.

I think it is now clear that one reckless man and very poor trader has tipped bitcoin into a severe bear market.

There is some good news in this, however. We now know what is going on, and while it may appear that he will be able to exert downward pressure on the market for some time, the trustee only has about $1.3 billion in bitcoin left to sell. I expect that bitcoin fans in Silicon Valley and at the larger OTC firms are now working feverishly to put together a group to buy them all.

Personally, I think that Amazon should buy them. As Jeff Bezos says, "Your margin is my opportunity." There is no better way to negotiate with Visa and Mastercard than while holding $1+ billion in bitcoin, the technology that will crush Visa and Mastercard's exorbitant fees. Additionally, Amazon's buying of the last of the Mt. Gox bitcoin would, in my opinion, double bitcoin's price.

This is all rank speculation on my part, but it isn't too hard to connect the dots. Bitcoin's technology continues to advance as Segwit adoption moves ahead and there are now nearly 1000 Lightning Network nodes active. Bitcoin's network has never appeared stronger, while the game theory aspect has pushed Germany to declare bitcoin exempt from capital gains taxes if used to purchase things. As such, bitcoin's most recent bear market may end very soon if we can clean up the sloppy seller.

Disclaimer: This is not to be construed as investment advice.

Wednesday, February 28, 2018

Most Bullish Bitcoin and Gold Item in Decades

In what is the biggest news I have seen in my 18 years of looking for an alternative to fiat, Germany has decided they won't place a capital gains tax on purchases made with crypto. This eliminates the double taxation of alternate currencies that is created from the debasement of fiat that I wrote about last week. This should benefit crypto gold as well. This should force other countries to move on this matter as well.

I Want to Like Gold, but.....

The world is short an honest money. Gold and bitcoin both offer better options than the current failing system, it is just that crypto keeps chipping away at some of what were gold's best attributes in ways that keep surprising me.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Let's take the ICO market. I have been skeptical here. It in many ways seems like an incredibly good deal for the issuer....free money upfront in exchange for a service that the customer may never redeem. In a way, it almost seems like the peak of the fiat bubble.

There is another, more positive, view of tokens. Let's examine Facebook as what may be possible here. Facebook could easily issue coins to their most important contributors to keep them loyal to the service. Facebook could then say to advertisers that 50% of their ad buys on the platform must be paid for with the tokens. This would create a giant market for FB tokens.

Believe it or not, this is a problem for gold. For those of us who believe that the system will rebalance through CPI type inflation (to rebalance the lopsided financial asset inflation of the past few decades), gold historically offered us the best way to protect ourselves from this. After all, if CPI inflation took hold, the rush would be on to build inventory of things you use before the price rose. Since it is generally difficult to inventory services (you can't get two haircuts this month just because you think the price will rise), you had to inventory things. Gold was what you inventoried because it was liquid and would rise in price faster than most other things since it provided you with the most flexibility (it is hard to resell canned peas if you decide you don't want them).

ICO's change all of this. Services, like advertising, or a coffee that can be paid for with a Starbuck's coin will allow you to inventory services fairly cheaply. Bitcoin will act as the new form of gold in this world, the most flexible asset. There will be a plethora of ways for one to inventory services in the future. One could almost think of these tokens as inflation etf's (depending on the structure of the coin). You pick the form of inflation you most want to protect yourself from.

Gold does retain one advantage that tokens lack however, gold cannot default. Nevertheless, long-term, tokens are a problem for gold.

Wednesday, February 21, 2018

The Problem with Centralization

Twitter has shut down thousands of accounts. The reason is unimportant, but the fact is that when a system is centralized those with views that are in opposition with those views of the central authority are at risk of being cutoff. This is very true in a system where money is centralized. Bitcoin's success is extremely important to those who do not want to see themselves arbitrarily removed from the financial system by some central authority. Just as Twitter and Facebook may remove your ability to speak on their platform for any reason, governments and central banks can do this on their centralized financial platform. Bitcoin is the answer.

Disclaimer: This is not financial advice.

Disclaimer: This is not financial advice.

A Big Reason to Trust Bitcoin Over Central Bankers

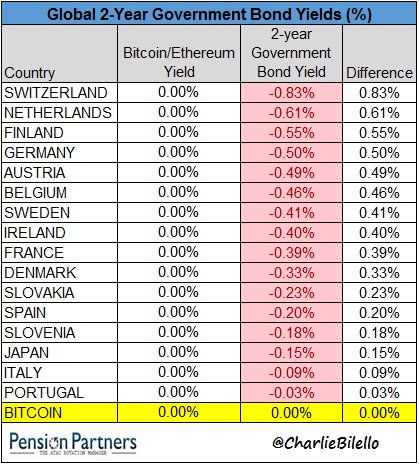

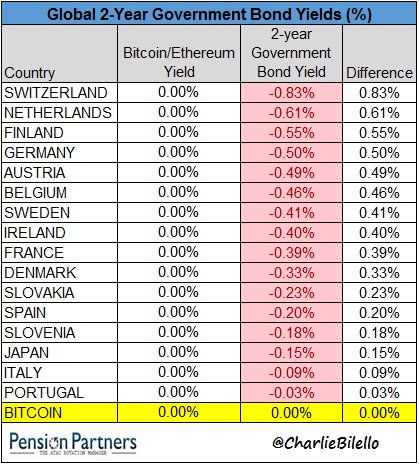

https://twitter.com/charliebilello/status/966325031189057537

Disclaimer: This is not investment advice.

Disclaimer: This is not investment advice.

Taxes and bitcoin

Central bankers and those cronies who sit close to them are mighty quick to dismiss bitcoin. Nevertheless, bitcoin's price rises. Impressively, it does so while fighting with one arm tied behind its back.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Bitcoin and gold, in the U.S. anyway, are taxed. That is, if you buy either of these assets and the price goes up due to central bank debasement of the currency, you must give up a portion of your holding to the government. It isn't that bitcoin or gold has changed, it is that government debasement of the currency lets the government steal from you twice: first when they print and someone (not you) gets something for nothing and then again when they point a gun at you and demand a tax payment. It is insane that people put up with this. The good thing is that it will change.

The game theory aspect of this will be interesting. Somewhere in the world, a country will want to establish itself as the place to be for bitcoin and blockchain. They will stop taxing it. Bill Tai thinks Japan is heading in this direction. Let's hope. The dominoes will then fall nearly everywhere.

Trust and bitcoin

Bitcoin is a horrible name. Trustnet would be better.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Andreas Antonopoulos

If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods. But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of the money it seems unlikely that bitcoin could ever be as convenient as existing payment methods.

New York Fed

Bitcoin is about trusting provable math versus the human frailty of central bankers.

A bitcoin investor

In the end, the success or failure of bitcoin versus fiat will come down to the issue of trust. Which currency and payment method will allow you to speak the most freely, to have your voice be heard? As I have already said, money and its use is a form of speech. Central bank debasement of fiat drowns out the speech of those who do not sit close to the central bank's free money spigot. Your voice is not heard. Your needs, desires and time preferences are ignored. Free fiat money gives a greater voice to the Buffett's and Munger's, the Dimon's and Singer's. Of course these people want bitcoin to fail.

Bitcoin's rise over the past nine years is a vote of distrust in central banking. As an Austrian, I have always known that artificially dropping interest rates created malinvestment. What the world is figuring out is that those who are cronies of the central banks do not have to worry about living with the failure of their malinvestments. Central banks will bail them out via debasement. This is creating serial investment bubbles, lowered savings, less real growth, and income and asset distribution distortions that would never be seen in a free market. This has led to a collapse in trust in the fiat system.

Bitcoin's price rise over the years is a referendum on the current state of the fraudulent financial system. The New York Fed has it wrong about bitcoin and the trust people have in the system. They are in denial. They are really worried that bitcoin exposes the fact that everything everyone at the Fed has been a part of has been wrong and corrupt. It is a difficult thing to admit. But for those central bankers, politicians and judges who refuse to admit it, the bitcoin world will grow and move on without you. Your attacks and denunciations may wound the community for a time, but bitcoin is, unlike fiat, anti-fragile and it will emerge stronger for its challenges. Fiat's day is already over. It has completely failed. We are only waiting on recognition of this event. The fiat world is not to be trusted and there is no stopping that. Meanwhile, bitcoin is a system without central control where debasement won't exist and your voice can be heard.

Disclaimer: This is not investment advice.

Monday, February 19, 2018

Game Theory and Rebalancing the System

Over the years I have had discussions about gold and the price required to rebalance the system. I think that I, and many others, have used this argument to quiet those who say there isn't enough gold out there to return to a system where gold is money. "Ridiculous," was the response. Just slap another zero onto the price (now maybe we need a 20 bagger) and voila, problem solved.

It is interesting to see this argument creeping into the bitcoin world. Foolish or not, Bill Tai at a recent Milken Institute conference proffered the theory that the Japanese government's rapid move to push bitcoin into use there is being done along these lines. He finds it amazing that a culture built on consensus where change happens slowly has pushed so rapidly and so hard on the bitcoin front. He considers the possibility a good one that the government knows there is almost no way out of their financial mess, and they hope that by being a first mover on crypto that its rapid appreciation will bail them out. Interesting.

You can see his comments here at about the 55:00 mark:

Cointelegraph also ran a story on the Polish central bank paying to run anti-crypto ads that was picked up at Zero Hedge. As I wrote last week, central bankers bashing bitcoin reminds me of the Max Planck argument about science progressing one funeral at a time. Planck understood that those in the scientific world who had operated their entire adult lives under certain assumptions about how the world worked were loath to accept new theories that rendered their life's work moot. Planck knew that it was almost impossible to convince these older folks that the new theory was correct. Only after they had all died was it possible for the new theory to be broadly accepted.

Many central bankers, I think, are like this with regard to bitcoin. It isn't that they don't understand bitcoin, they do. What the really fear is that bitcoin renders them and their life's work of fiat promotion moot.

Where the Planck Theory that I proposed above goes awry is that there may be a big game theory aspect to the acceptance and rejection of bitcoin and crypto. It will be interesting to watch. Poland and China are at one end of the spectrum with Japan and Switzerland at the other. There may come a time where wide scale bitcoin acceptance pushes even the most reluctant into bitcoin acceptance. It may even have already happened.

Disclaimer: This doesn't constitute investment advice.

Saturday, February 17, 2018

What Happened to Bitcoin in 2017

By all accounts, bitcoin's rise in 2017 was meteoric. What does this mean? Why did it happen?

One of the principle tenets of this blog is that fiat money has been abused through endless rounds of central bank debasement and this has created many problems. Those of us who hold fast to the ideas of Austrian Business Cycle Theory have very different ideas than do most economists as to what impact this debasement has on the economy. Austrians believe that printing money distorts interest rates and time preferences and these things will impact the very structure of the economy in a way that the market doesn't appreciate. That is, people do stupid things when the information (interest rates) they are given is distorted. The economic result is malinvestment.

In this sense, money is a subset of speech. Money, and the way we use it, tells the world what we like, what interests us and what our time preferences are. Money and its use contains extremely important information. To get at truth, speech needs to be free, and this is also true for money. It should never be distorted so that the information is skewed in a way that only benefits those in power or those who sit closest to the central banks. There will be no truth or justice there. Central banks have skewed the fiat money system in a way that truth, justice and free speech are denied to most. Bitcoin's dramatic rise in 2017 is a recognition of this.

Since the Great Financial Crisis of 2008, I think that people have had an underlying sense that the financial system has been skewed against them and in favor of the one percent. The individual has seen his free speech silenced by Ben Bernanke, Janet Yellen, Draghi and Kuroda with their distortion of money and interest rates. People are yearning to speak freely, to speak truthfully and to have their voices heard. That is what happened to bitcoin in 2017. People have found their voice again through the purchase of bitcoin and this time I pray that they won't let it be silenced.

Disclaimer: This does not constitute investment advice.

One of the principle tenets of this blog is that fiat money has been abused through endless rounds of central bank debasement and this has created many problems. Those of us who hold fast to the ideas of Austrian Business Cycle Theory have very different ideas than do most economists as to what impact this debasement has on the economy. Austrians believe that printing money distorts interest rates and time preferences and these things will impact the very structure of the economy in a way that the market doesn't appreciate. That is, people do stupid things when the information (interest rates) they are given is distorted. The economic result is malinvestment.

In this sense, money is a subset of speech. Money, and the way we use it, tells the world what we like, what interests us and what our time preferences are. Money and its use contains extremely important information. To get at truth, speech needs to be free, and this is also true for money. It should never be distorted so that the information is skewed in a way that only benefits those in power or those who sit closest to the central banks. There will be no truth or justice there. Central banks have skewed the fiat money system in a way that truth, justice and free speech are denied to most. Bitcoin's dramatic rise in 2017 is a recognition of this.

Since the Great Financial Crisis of 2008, I think that people have had an underlying sense that the financial system has been skewed against them and in favor of the one percent. The individual has seen his free speech silenced by Ben Bernanke, Janet Yellen, Draghi and Kuroda with their distortion of money and interest rates. People are yearning to speak freely, to speak truthfully and to have their voices heard. That is what happened to bitcoin in 2017. People have found their voice again through the purchase of bitcoin and this time I pray that they won't let it be silenced.

Disclaimer: This does not constitute investment advice.

Thursday, February 15, 2018

A Couple of Random Observations

Charlie Munger of Berkshire Hathaway called bitcoin "noxious poison" the other day. Well, to a guy whose business depends on an endless supply of easy money from central banks that transfers wealth from savers to leveraged hedge funds like Berkshire Hathaway, I am certain bitcoin is noxious poison. Good thing, too.

Munger then went on to say that regulators should let up on Wells Fargo, a firm that deliberately set out to open fake accounts and enroll customers in programs that they didn't want and weren't told that they would be charged for. That is, they flat out stole from their customers.

Munger couldn't be more socially tone deaf if he had slapped a couple of female underlings on their backsides and told them they should like it. I think someone needs to keep the 93 year old Munger from embarrassing himself any further.

Finally, noted VC Bill Gurley said that everyone is nauseous from talking so often about crypto and that he wished it would stop. Sorry Bill, the market potential is too big and bitcoin's implications for our freedom and liberty are too important. Did Thomas Jefferson talk too much about man's natural rights in the Declaration of Independence? Should Galileo have stopped talking about the sun being at the center of the universe?

Important ideas will not suffer from too much discussion. Take some Pepto and tough it out.

Disclaimer: This does not represent investment advice.

Munger then went on to say that regulators should let up on Wells Fargo, a firm that deliberately set out to open fake accounts and enroll customers in programs that they didn't want and weren't told that they would be charged for. That is, they flat out stole from their customers.

Munger couldn't be more socially tone deaf if he had slapped a couple of female underlings on their backsides and told them they should like it. I think someone needs to keep the 93 year old Munger from embarrassing himself any further.

Finally, noted VC Bill Gurley said that everyone is nauseous from talking so often about crypto and that he wished it would stop. Sorry Bill, the market potential is too big and bitcoin's implications for our freedom and liberty are too important. Did Thomas Jefferson talk too much about man's natural rights in the Declaration of Independence? Should Galileo have stopped talking about the sun being at the center of the universe?

Important ideas will not suffer from too much discussion. Take some Pepto and tough it out.

Disclaimer: This does not represent investment advice.

Suppression

A decade ago my daughter started competitive swimming. I was impressed by how much work went into the sport. She trained 18 hours per week and went to school. Her dedication also had me paying attention to other developments in the sport.

At about that time USA Swimming, the national organizing body, was undergoing harsh criticism for its having swept many sexual abuse allegations under the rug over the years. The pressure grew and USA Swimming was forced to change its ways and its attitude toward sexual abuse of swimmers by their coaches. A tsunami of charges were unleashed as young women felt that they would now get a fair hearing. The result, there are now 149 people, mostly men, banned by USA Swimming. It has been quite shocking that this level of abuse existed in a sport for children.

Then came Harvey Weinstein. The sad thing here is that it seemed like almost everyone knew what was going on, yet they allowed it to happen anyway. People were willing to look the other way for a chance to get their film made, to get the part or to become a screenwriter (sounds just like the financial markets to me).

Finally, Oprah (who needs no last name) gave an incredibly powerful speech at the recent Golden Globes about the abuse and suppression of women. The reception to her words resulted in there being much talk about her running for president in 2020.

The suppression and abuse of women has exploded into what may be the dominant social issue of the day. I am pretty certain this is not going to blow over.

This brings me to the many other avenues of suppression over a long period of time where anger will build over the scale of the abuse. From the perspective of a blog on economics, the massive suppression of interest rates, volatility and gold prices have harmed millions and will be exposed. This type of suppression is always impossible to hide forever in the economic world. There will be a reckoning. Judgment is coming for the world's irresponsible central bankers.

Disclaimer: This doesn't represent investment advice.

At about that time USA Swimming, the national organizing body, was undergoing harsh criticism for its having swept many sexual abuse allegations under the rug over the years. The pressure grew and USA Swimming was forced to change its ways and its attitude toward sexual abuse of swimmers by their coaches. A tsunami of charges were unleashed as young women felt that they would now get a fair hearing. The result, there are now 149 people, mostly men, banned by USA Swimming. It has been quite shocking that this level of abuse existed in a sport for children.

Then came Harvey Weinstein. The sad thing here is that it seemed like almost everyone knew what was going on, yet they allowed it to happen anyway. People were willing to look the other way for a chance to get their film made, to get the part or to become a screenwriter (sounds just like the financial markets to me).

Finally, Oprah (who needs no last name) gave an incredibly powerful speech at the recent Golden Globes about the abuse and suppression of women. The reception to her words resulted in there being much talk about her running for president in 2020.

The suppression and abuse of women has exploded into what may be the dominant social issue of the day. I am pretty certain this is not going to blow over.

This brings me to the many other avenues of suppression over a long period of time where anger will build over the scale of the abuse. From the perspective of a blog on economics, the massive suppression of interest rates, volatility and gold prices have harmed millions and will be exposed. This type of suppression is always impossible to hide forever in the economic world. There will be a reckoning. Judgment is coming for the world's irresponsible central bankers.

Disclaimer: This doesn't represent investment advice.

Friday, February 9, 2018

Max Planck and Bitcoin

Max Planck understood that many scientists who had spent their entire lives operating under a certain set of assumptions about how the world worked would recoil in horror at new theories that rendered their life's work moot. The old guard was always reluctant to accept a new theory, no matter what the evidence:

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Max Planck

As we see central bankers throw out disparaging remarks concerning bitcoin, I would encourage you to think about Planck's insight. I believe that our children, and our children's children, will laugh at the concept of trusting central bankers with their money. It is these old guard central bankers who refuse to accept the new reality. It isn't that they don't understand bitcoin, I believe they do. It is that bitcoin forces them to realize that they have wasted their lives promoting a world that runs on fiat money. This is what they really hate.

Disclaimer: This is not investment advice.

A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.

Max Planck

As we see central bankers throw out disparaging remarks concerning bitcoin, I would encourage you to think about Planck's insight. I believe that our children, and our children's children, will laugh at the concept of trusting central bankers with their money. It is these old guard central bankers who refuse to accept the new reality. It isn't that they don't understand bitcoin, I believe they do. It is that bitcoin forces them to realize that they have wasted their lives promoting a world that runs on fiat money. This is what they really hate.

Disclaimer: This is not investment advice.

Weaponizing Money

He probably won't be mentioned in the same breath as the cypherpunks or other early bitcoin pioneers, but my guess is that his influence on the bitcoin movement will prove to have been a powerful one. He is Juan Zarate, former deputy national security advisor for combating terrorism.

His contribution was the weaponizing of the dollar via the use of draconian financial embargoes against entire countries. He now worries that bitcoin and other cryptocurrencies may allow countries that the U.S. labels as bad actors a way around these embargoes.

The reality is that such draconian actions will force not only bad actors to think about using alternatives to the dollar in international trade, but it will force many legitimate companies and individuals to explore alternatives as well. China and Russia have already built an alternative to SWIFT payment platform. No doubt that legitimate individuals and companies worldwide are exploring bitcoin in case the U.S. targets their country or their suppliers or customers. The U.S. is proving itself to be a less than reliable partner on the monetary front, and this extends well beyond the debasement argument.

As Nick Szabo, one of the early cypherpunks explains:

The historically recent growth of centralized digital money has resulted in the transformation of money from being a medium of exchange, to many officials viewing it as primarily a medium of law enforcement. This is increasingly making such money more local and less trustworthy.

The U.S. certainly seems intent on destroying the dollar.

Disclaimer: This does not represent investment advice.

His contribution was the weaponizing of the dollar via the use of draconian financial embargoes against entire countries. He now worries that bitcoin and other cryptocurrencies may allow countries that the U.S. labels as bad actors a way around these embargoes.