The Economist magazine

recently ran an article detailing some surprising results of a paper published

by three finance researchers from MIT, Dartmouth and the University of

Rochester.

From the Economist:

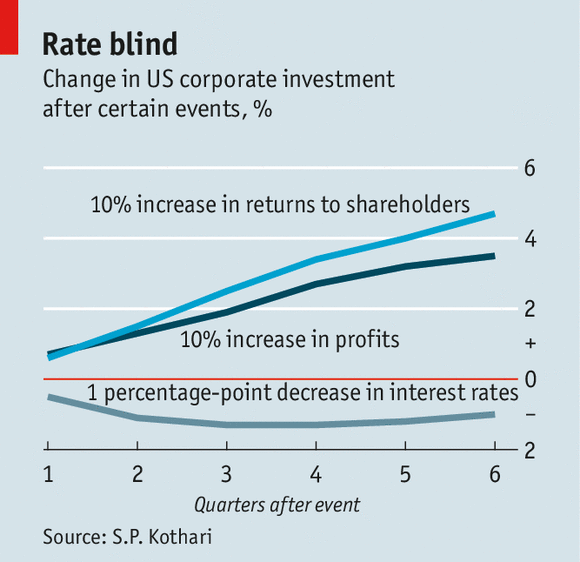

IT IS Economics 101. If central bankers

want to spur economic activity, they cut interest rates. If they want to dampen

it, they raise them. The assumption is that, as it becomes cheaper or more

expensive for businesses and households to borrow, they will adjust their

spending accordingly. But for businesses in America, at least, a new study* suggests that the

accepted wisdom on monetary policy is broadly (but not entirely) wrong.

What surprised the Economist was that a

decrease in interest rates actually caused a decline in capital spending:

While this was counterintuitive to

Keynesian trained analysts, it is not for those versed in Austrian economics.

Occasionally,

we all may have a burst of real insight into a situation that doesn’t jibe with

conventional wisdom. With regard to Austrian Business Cycle

Theory, mine came while reading the Roger Garrison summary of The AustrianTheory of the Trade Cycle:

On page 114 Garrison drew a simple supply and demand graph

of loanable funds (savings). He showed that as you dropped interest rates

artificially, via Fed money printing, the level of loanable funds would fall.

It was a simple and elegant insight, yet it was extremely radical in

terms of traditional economic thought. The Keynesians were, I realized then and

there, entirely wrong. Money creation from thin air was not neutral to the

capital structure of the economy, but had profound impacts. It changed

everything for me.

So, now that some

traditional economic platforms are starting to understand that the real world

doesn’t act in a way that Keynesian economics would predict, what should we

expect to see happen? I am going to go along with Winston Churchill on this

one:

Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing ever happened.

Men occasionally stumble over the truth, but most of them pick themselves up and hurry off as if nothing ever happened.

Disclaimer:

Nothing on this site should be construed as investment advice. It is all merely

the opinion of the author.

No comments:

Post a Comment